Traffic at the Port of Los Angeles set to plunge amid tariffs

Published in Business News

Imports at the Port of Los Angeles are expected to plunge in the next two weeks, even as negotiations over the final tariffs that China and other countries must pay are still being negotiated by President Trump.

That was the sobering message that port Executive Director Gene Seroka had Thursday for the Los Angeles Board of Harbor Commissioners during an update on port activity.

"It's my prediction that in two weeks' time, arrivals will drop by 35% as essentially all shipments out of China for major retailers and manufacturers have ceased, and cargo coming out of Southeast Asia locations is much softer than normal," Seroka told the board.

Figures from Wabtec Corp., which tracks port cargo, predict the slowdown in container volume hitting as soon as next week. That's when 17 vessels are scheduled to arrive with 85,486 20-foot-equivalents (TEUs) of goods, down 28.6% from this week and 10.5% from last year.

The decline will continue the following week, when 16 vessels are supposed to arrive carrying 74,925 TEUs, down nearly 33% from last year, according to Wabtec.

The drop-off follows a period of higher import volume as companies tried to get ahead of the tariffs.

Seroka pointed to the current 145% tariff rate on Chinese goods and the 10% across-the-board tariffs that apply to nearly all nations as suppressing demand from U.S. retailers and manufacturers.

And even though Trump on April 9 announced a 90-day pause on reciprocal tariffs many nations may have to pay, Seroka said, "that's not a lot of lead time for the industry to make decisions on procurement, manufacturing, locations or sourcing."

"Many major retailers have told us they've got about a six-to-eight-week supply of inventory in their systems now that will quickly dry up," he said. "United States consumers and manufacturers alike will find difficult decisions in the weeks and months to come if policies don't change."

Seroka said he expects exports to be hit even harder. In March, the port moved 123,000 TEUs, down 15% from a year earlier — the fourth straight month of decline on a year-over-year basis. He said retaliatory tariffs are hitting agriculture, heavy duty manufacturing and the information technology and services sectors.

"In March, China bought more soybeans from Brazil in one month than ever in their history. Favorable exchange rates and no tariff barriers led to that procurement behavior," he said.

The slowdown is expected to have a ripple effect at the port, though Seroka said he didn't envision "mass layoffs."

"But if you're a trucker and you're hauling four or five containers today, you may haul two or three in the future. If you're a dock worker who's been getting OT... or getting a full workweek, that may be dialed back as well," he said, with casual workers being hit the hardest.

Seroka's assessment follows the release of a report earlier this week by the Los Angeles County Economic Development Corp. that found the tariffs threaten Southern California's critical trade and logistics industry.

The industry, including the Port of Long Beach, transportation workers and far-flung warehouses, contributed nearly $300 billion in direct economic output and an estimated $93.3 billion in tax revenue in 2022, according to the report.

The sector supported nearly 2 million jobs, directly employing more than 900,000 workers with an average salary of more than $90,000, which was 26% higher than the average annual wage across Southern California, the report said.

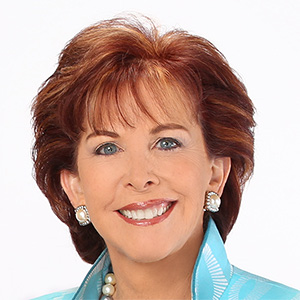

Carol Schleif, chief market strategist at BMO Private Wealth, noted that executives from Walmart, Amazon and Home Depot visited the White House this week to plead their case against tariffs.

She said that while the tariffs may get negotiated down, the port numbers suggest that some companies may be easing off purchases in advance of the critical holiday shopping season — even if the China tariffs are reduced.

"I'm hearing anecdotal evidence that some smaller and mid-sized retailers flat out can't afford it," she said.

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments