UWM acquires mortgage servicer in $1.3 billion all-stock deal

Published in Business News

In a move that significantly expands its footprint in the mortgage servicing landscape, Pontiac, Michigan-based United Wholesale Mortgage Holdings Corp. said Wednesday it would acquire Two Harbors Investment Corp. in an all-stock deal valued at $1.3 billion.

The merger combines United Wholesale Mortgage with Two Harbors, a real estate investment trust and a servicer of conventional mortgages through its subsidiary, RoundPoint Mortgage Servicing LLC.

The transaction is based on a fixed exchange ratio of 2.3328 shares of UWM for each share of Two Harbors, which is based in St. Louis Park, Minnesota. It represents an $11.94 per share value based on UWM’s closing price Tuesday.

UWM shareholders will own approximately 87% of the combined company on a pro forma fully diluted basis, while Two Harbor's shareholders will own the remainder in a tax-free transaction. The board of the combined company is expected to expand to 11 directors, with one additional member designated by Two Harbors.

The merger will boost UWM’s public float to approximately 513 million shares — a 93% increase that could improve liquidity for the stock on the New York Stock Exchange, the release stated.

By absorbing Two Harbors’ $176 billion mortgage servicing rights portfolio, UWM will nearly double its portfolio to about $400 billion. This jump will make the combined entity the 8th largest mortgage servicer in the United States, according to a news release.

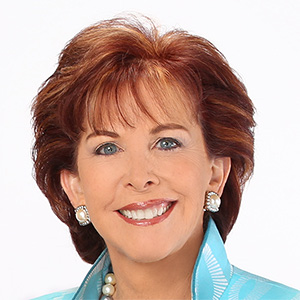

“This transaction is a true win for both stockholders and our mortgage broker partners,” said Mat Ishbia, chairman and CEO of UWM, in the release. “The timing of doubling our servicing book as we bring servicing in-house is the perfect alignment, allowing us to deliver meaningful upside to stockholders and leverage increased cash flow to invest deeper into the broker network.”

The acquisition comes as UWM transitions its servicing operations in-house. By integrating Two Harbors’ capital markets expertise and RoundPoint’s servicing platform, UWM expects to realize roughly $150 million in annual cost and revenue synergies, the release stated.

Bill Greenberg, CEO of Two Harbors, said in the release that the current economic climate favors such consolidation. “Scale has become more important than ever in the mortgage industry,” Greenberg said. “We are very excited to partner with the largest mortgage lender in the country.”

Beyond the balance sheet, UWM leadership said the deal would provide a competitive edge for its independent mortgage broker partners. The expanded servicing portfolio is expected to generate a steady stream of leads, helping brokers retain past clients and attract new ones, the release said.

The combined company will remain headquartered in Pontiac.

©2025 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments