Retirement, interrupted: Why those over 55 are a fast-growing segment of the workforce

Published in Slideshow World

Subscribe

Retirement, interrupted: Why those over 55 are a fast-growing segment of the workforce

Joan Madden-Ceballos, a 65-year-old health care administrator, has a working life in California many would envy. Her work is flexible, fulfilling, and something she enjoys going back to day after day. "I'm a baby boomer, so work is sort of ingrained in our lives," she told Vox.

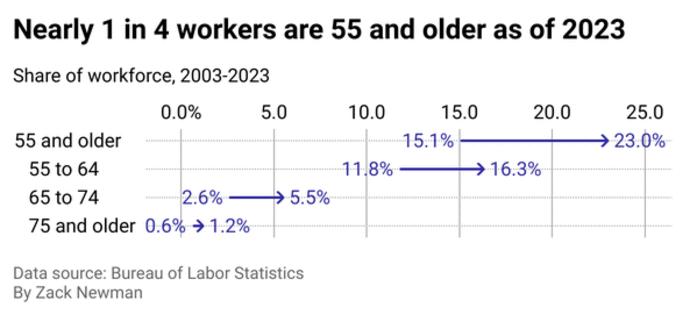

While it may sound unusual for some to work past what many consider the "golden years" of retirement, Madden-Ceballos is among the increasing number of Americans who have stuck around the workforce longer as they age, according to federal data. Per 2023 data from the Bureau of Labor Statistics, more than 1 in 5 workers are 55 or older. Three in 20 working Americans are aged 55 to 64, while roughly 7 in 100 are older than 64.

From 2003 to 2023, there was a sizable jump in people 55 and older still in the workforce—nearly a 74% increase—but there were also profound jumps in those working who are 65 and older. The number of workers aged 65 to 74 jumped 139%, and those 75 and older increased by 113%.

Health Centers Near Me explored data from the Bureau of Labor Statistics to examine why the aging workforce in the United States is working past the typical retirement age.

Visit thestacker.com for similar lists and stories.

With longer lives and better health, seniors are choosing to work

There are a few reasons why many seniors are choosing to work past their retirement age.

Older Americans today are living longer and maintaining their physical independence longer. According to Centers for Disease Control and Prevention estimates, the average 65-year-old was expected to live another 18.9 years in 2022, compared to just 17.6 years in 2000. A 2023 study of 5.4 million older Americans published in the International Journal of Environmental Research and Public Health also found that across 10 years, the number of people 65 and over with functional limitations had decreased significantly.

Work may be a way to stay active in society for some older Americans. Workers aged 50 and older told researchers their jobs have had a positive effect on their physical and mental health, according to the 2024 University of Michigan National Poll on Healthy Aging. Nearly half said that work gave them a sense of purpose and kept their brains sharp. This reality is even more consistent for workers aged 65 and older, with 9 in 10 saying that working helped their overall well-being.

The nature of jobs has also changed. Nicole Maestas, professor of economics and health care policy at the Harvard Medical School, noted that "many people have less physically demanding jobs in today's information economy, so for some, it is easier to continue working."

A survey of 2,000 individuals aged 50 to 79 published by the National Bureau of Economic Research also found that job characteristics affect people's decision to retire. According to researchers, nearly a third would likely keep working past 70 if their job offered flexible hours compared to just a sixth without that option. Job stress, the physical and mental demands of the job, telecommuting options, or commuting times were other factors that played into that decision.

Still, a sense of purpose and job characteristics are only part of the picture. When asked why workers aged 50 and older might keep working, the top reasons the University of Michigan poll respondents gave were related to finances. Nearly 4 in 5 (78%) workers said financial stability is what keeps them clocking in, followed by saving for retirement and access to health insurance.

Some older Americans can't afford to stop working

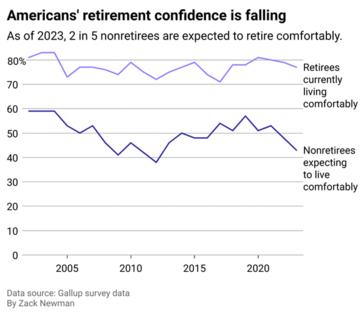

On multiple surveys, people reported a bleak savings picture and perspective on retirement. For a 2024 AARP survey, 2 in 3 adults older than 50 reported not having enough savings to be "financially secure" in retirement. In 2023, 2 in 5 respondents told Gallup they expected "to live comfortably in retirement," down from 3 in 5 in 2002.

Numerous factors could be driving this sentiment.

People could be working longer because a dollar does not stretch as far as it used to. Wages have stagnated, while the cost of goods, measured by the Consumer Price Index, has steadily increased. Renting or buying a home costs thousands of dollars more today than decades ago. Gen Z dollars could buy only about 86% of what baby boomers could in their 20s, according to Consumer Affairs.

A few decades ago, pensions were also more common. Employers managed the money for their employees' pensions, known as defined benefits plans, and paid employees for life after retirement. It was a guaranteed income benefit that typically started at a specific age, like 62, incentivizing older workers to plan for retirement. Benefit pensions became less common because of the unpredictable cost to employers.

Why older Americans are working longer

By the 1980s, defined contribution plans like 401(k)s became more widespread. These plans typically lack age-specific requirements, found Courtney Coile, a researcher in the economics of aging and health at Wellesley College, leading to a six-month increase in the average retirement age. A quarter of those return to work within six years in part- or full-time jobs.

Researchers from the Georgetown Center for Retirement Initiatives also found that while current estimates use older generations with pensions as a basis for forecasts, newer retirees tended to draw down their savings at much faster rates, fueled in part because of longer life expectancies that increased the need for more funds to pay for health care and long-term necessities. Consequently, new retirees may exhaust their 401(k) assets by 85 years of age, likely outliving their savings.

Some older Americans may not even have enough to begin with. The Government Accountability Office found in 2024 that half of households did not have any retirement savings as of 2022, and a third of households with a worker 55 or older did not have any retirement or defined benefit plan set by an employer to fall back on.

People may be working longer to delay pulling Social Security benefits, even increasing their monthly payments. Yet the existing financial safety net for older Americans is fraying. Social Security may run out of money in less than a decade. The additional source of income for older workers, driven by a lifetime of workers' wages, is projected to be insolvent by 2033 without congressional action, stated the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds in its 2024 annual report. Social Security and Medicare alone are insufficient for people to make ends meet. Half of older adults living alone, as well as 1 in 5 older couples, "lack the financial resources required to pay for basic needs," according to a 2022 study led by three gerontologists from the University of Massachusetts Boston.

"There's a myth that Social Security and Medicare miraculously take care of all of people's needs in older age," Ramsey Alwin, president and chief executive of the National Council on Aging, told KFF Health News. "The reality is they don't, and far too many people are one crisis away from economic insecurity."

What can be done better?

Several reforms need to happen to help older Americans—and the nation—prepare for the future as aging workers participate more in the economy.

Scholars from the AARP Public Policy Institute, the Wharton School of the University of Pennsylvania, and the Brookings Institution are proponents of workers setting up dedicated emergency accounts that separate one's emergency savings from general savings, making it less likely to be spent for other needs. They also suggest that states explore putting employees into automatic individual retirement accounts unless they already have retirement plans. Vermont and 17 other states are already considering implementing these auto-IRAs, according to Time. They are also encouraging the government to explore ways to make it easier for employees to move their retirement balances from one plan to another, making their hard-won savings less likely to be abandoned or forgotten.

Employers can also take some proactive steps, knowing that older Americans will only be more present in the workplace. Employers can promote skills training for everyone, allow flexible work options, give workers a say in their schedules and work locations, and create an ergonomic workplace that addresses hazards more commonly faced by older workers, who may be more adversely affected by slips and trips. These changes may also benefit all generations in the workplace.

Strengthening financial security for an aging workforce

Leaders can also push back on harmful myths that affect older workers like their supposed opposition to change or decreased productivity. AARP research has found that almost 13 in 20 workers aged 50 and older reported seeing or experiencing age discrimination in the workplace.

Finally, older employees who may not have enough money can try to improve their retirement outlook with a handful of strategies, CNBC reported. The first step is to calculate how much they might actually need for retirement rather than guessing. The Elder Index, developed by the Gerontology Institute at the University of Massachusetts Boston, is a tool that can help older workers pinpoint how much they need.

Some workers may also consider shifting to part-time work before retiring fully.

Workers should also take advantage of IRS tax incentives aimed at helping workers save for the future. The Saver's Credit could provide up to 50% of one's contribution based on a filer's adjusted gross income. There are also catch-up contributions workers aged 50 and older can make to add to their retirement savings beyond the plan type or IRA contribution limit.

By 2040, people 65 and older are expected to comprise nearly a quarter of the nation's population, according to the Administration for Community Living, an operating division of the Department of Health and Human Services. As the nation ages, the country will increasingly depend on older workers to fuel the country's economic activity. It would be ideal to have a working future, like Star Bradbury, the Gainesville, Florida-based author of "Successfully Navigating Your Parents' Senior Years."

"I know for myself that I am happier when I am working and happier when I am helping other people," Bradbury told the Mainstreet Daily News. She said that, at 75 years old, her job as an author and senior living strategist gave her "a sense of purpose and don't mind earning a little extra money. All those things add up to keep me working."

Story editing by Carren Jao. Copy editing by Sofía Jarrín. Photo selection by Lacy Kerrick.

This story originally appeared on Health Centers Near Me and was produced and distributed in partnership with Stacker Studio.

Comments