Trump says millionaire tax would push wealthy to leave the US

Published in Political News

WASHINGTON — President Donald Trump said that imposing a higher tax rate on millionaires would spur the country’s richest to leave the U.S., downplaying an idea that is under discussion in some Republican circles as a way to pay for an economic package.

“I think it would be very disruptive because the millionaires would leave the country,” Trump told reporters in the Oval Office on Wednesday. “Other countries that have done it have lost a lot of people. They lose their wealthy people. That will be bad because the wealthy people pay the tax.”

Trump’s remarks are likely to pour cold water on discussions about creating a new 40% tax bracket for people earning $1 million or more. Some members of the party in both the House and Senate have said they’re open to raising levies on top earners to help pay for other pieces of Trump’s agenda, which include proposals to end taxes on tips and overtime.

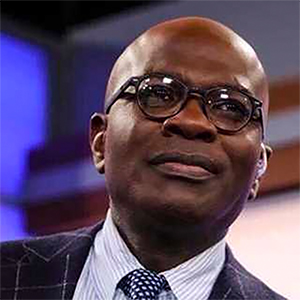

House Speaker Mike Johnson earlier Wednesday said he does not “expect” a Republican tax bill to call for raising income tax rates on millionaires.

“We have been working against that idea. I’m not in favor of raising the tax rates. Our party is the party that stands against that traditionally,” Johnson said in an interview on Fox News on Wednesday.

Proponents for the idea see it as a way to defuse Democratic attacks ahead of the midterm elections that the party is cutting services for the poor to pay for tax cuts for the rich. But the GOP’s anti-tax establishment has been mobilizing against the threat to decades of party orthodoxy.

Trump and Johnson’s comments about a possible new millionaire tax bracket come amid growing backlash from some Republicans. Former Republican House Speaker Newt Gingrich on Tuesday posted on X that he received a message from Trump that suggested that raising taxes could harm Republicans at the ballot box.

Lawmakers will return to Washington next week when they will begin debating the details of a tax package that Johnson said he plans to pass out of his chamber by the end of May.

A 40% tax rate on income over $1 million would generate about $400 billion in revenue over the next decade, according to some estimates. That would be enough to add about $500 a year to the child tax credit.

The top tax rate is now 37%, but will snap back to 39.6% if Trump’s first-term income tax cuts expire on schedule at the end of 2025.

_____

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments