RFK Jr. plans crackdown on pharma ads in threat to $10 billion market

Published in Business News

The Trump administration is discussing policies that would make it harder and more expensive for pharmaceutical companies to advertise directly to patients, in a move that could disrupt more than $10 billion in annual ad spending.

Although the U.S. is the only place, besides New Zealand, where pharma companies can directly advertise, banning pharma ads outright could make the administration vulnerable to lawsuits, so it’s instead focusing on cutting down on the practice by adding legal and financial hurdles, according to people familiar with the plans who weren’t authorized to speak publicly on the matter.

The two policies the administration has focused in on would be to require greater disclosures of side effects of a drug within each ad — likely making broadcast ads much longer and prohibitively expensive — or removing the industry’s ability to deduct direct-to-consumer advertising as a business expense for tax purposes, these people said.

The discussions are ongoing and plans could still change before the agency undertakes any action, they said.

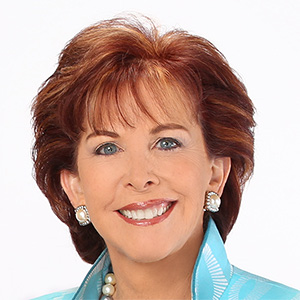

Limiting pharma ads would be a major win for Health and Human Services Secretary Robert F. Kennedy Jr. He’s long wanted to more strictly regulate how medicines are promoted. He’s said he believes Americans consume more drugs than people in other countries because of the U.S. drug companies’ ability to directly advertise to consumers.

The new policies could threaten a key source of revenue to advertising and media companies, as well as the U.S. pharmaceutical industry. Companies spent $10.8 billion in 2024 on direct-to-consumer pharmaceutical advertising in total, according to a report from the advertising data firm MediaRadar.

AbbVie Inc. and Pfizer Inc. were particularly big spenders. AbbVie alone spent $2 billion on direct-to-consumer drug ads last year, primarily on advertising for the company’s anti-inflammatory drugs Skyrizi and Rinvoq. The medicines brought in more than $5 billion for AbbVie in the first quarter of 2025.

“We are exploring ways to restore more rigorous oversight and improve the quality of information presented to American consumers,” HHS spokesperson Andrew Nixon said in a written statement, adding that no final decisions have been made.

AbbVie shares fell as much as 2.3% on Tuesday, their biggest drop in a month. Pfizer shares slipped as much as 1.7%.

Ad reversal

Before the loosening of advertising regulations by the Food and Drug Administration in 1997, U.S. pharma companies had to list all possible side effects for a medication if they wanted to mention which condition the drug being advertised was intended to treat.

Reading out a list of side effects took so long it drove up the cost for air time and meant there wasn’t as much broadcast advertising as there is today, said Jim Potter, executive director of the Coalition for Healthcare Communication, a trade association.

The FDA change allowed ads to disclose fewer side effects and also allowed companies to direct customers to talk to their doctors, call a telephone number, or visit a website to get more information on the advertised drugs. In the following years, TV pharma ad spending surged.

In 2024, 59% of the pharmaceutical industry’s spend was on television advertising, making pharma the third-highest spending industry on television ads, according to MediaRadar.

If the Trump administration brings back some of those restrictions, broadcast ads may become more “impractical,” according to Meredith Rosenthal, a professor of health economics and policy at Harvard University’s school of public health, who has studied the impacts of pharma advertising.

More specific drug ads could have benefits for patients who might be prompted to talk to their doctor for the first time about a medical condition like depression or erectile dysfunction, Rosenthal said.

However, there are also drawbacks. Drug ads can be used to drive sales of expensive, brand-name medicines when lower-cost generic alternatives may be appropriate, she said.

When asked if a crackdown on ads would hurt its business, AbbVie chief commercial officer Jeff Stewart told analysts at a conference in May that the company “would have to pivot.” He said the company could shift its investment to “disease awareness” or through advertising on digital channels rather than through mass media.

Tax changes

The Trump administration could also work with Congress to prohibit pharmaceutical companies from deducting direct-to-consumer advertising costs as business expenses on their taxes.

House lawmakers discussed the idea in talks over President Donald Trump’s tax cut legislation, but ultimately left the measure out of the bill. The Senate omitted it as well. HHS has been supportive of those discussions, according to a person familiar with the talks.

Kennedy has also said publicly he’s having conversations about tax changes within the administration, telling Senator Josh Hawley during a May hearing on Capitol Hill that he expected an announcement on the matter “within the next few weeks.”

Joe Grogan, who served as White House Domestic Policy Council chief during President Donald Trump’s first term and now consults for health-care companies, said it’s unclear whether lawmakers will have an appetite to crack down on the pharmaceutical industry further given Trump’s tariff threats and demands to dramatically lower drug prices.

Meanwhile, the pharmaceutical industry has warned that allowing lawmakers to regulate advertising by changing the tax code to single out pharmaceutical companies could set a dangerous precedent and raise the specter of lawsuits. Other industries also can deduct advertising costs as business expenses, heightening concerns they could be targeted next.

“If you choose a sector, if one becomes a target, everyone becomes a target,” said Potter of the Coalition for Healthcare Communication.

The National Association of Broadcasters, which represents companies that own radio and television stations, said the group opposes restrictions on direct-to-consumer advertising, and that revenue from ads allows local broadcasters to staff newsrooms and invest in weather technology.

“Restricting pharmaceutical ads would have serious consequences for stations, particularly those in smaller markets, and could raise First Amendment concerns,” NAB spokesperson Alex Siciliano said.

(With assistance from Madison Muller.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments